How to Buy DigixDAO | Ultimate Guide To Buy DGD

As technology continues to play a prominent role in our lives, we would witness an increasing pace of digitisation in financial assets. One cryptocurrency that perhaps meets this need is DigixDAO (DGD), which offers the opportunity to invest in gold through tokenised coins. However, the bigger picture opens up avenues through which commodities can be tokenised and traded. Those who invest in cryptos like DigixDAO are listened to benefit from the first-mover advantage.

In this guide, you will learn everything you need to know on how and where to buy DigixDAO DGD.

5 Steps to Buy Digixdao Instantly!

-

1Visit our recommended platform to buy Digixdao by clicking the button below.

-

2Enter your details in the required fields to create a new account.

-

3Fund your account using your preferred payment method and confirm your new balance.

-

4Choose Digixdao and select a "Instant/Market Order” to buy it instantly.

-

5Enter the amount you want to buy (you’ll see the equivalent in DGD) and confirm your order!

Our Recommended Platform to Buy DigixDAO

There are different platforms to buy DigixDAO. Considering the number, choosing one can be a daunting task. To help you in this complex process, we have compiled a list of brokerage platforms and exchanges where you can trade DigixDAO safely and with the best services on the market. Let’s jump right in and check them out.

Where to Buy DigixDAO in 2024

There are different ways to invest in DigixDAO. You can decide to trade it or buy and hold; what matters the most is using a strategy that suits your investment objective. Trading DigixDAO implies using charts and technical analysis to determine entry and exit points. A trader hopes to profit from volatility and price movements and not fundamentals.

Holding implies buying and holding for the long term. A holder depends on fundamental factors to choose his asset class, and purchases DGD with the intention of waiting for price appreciation in the future. This means that this class of investor is not adversely affected by short-term fluctuations in price, and needn’t worry about learning technical trading skills.

You can also invest in cryptocurrencies using CFDs. CFDs, or contracts for difference, allow you to speculate on the price of cryptocurrencies without having to take ownership of the underlying assets. Just like trading, you merely want to profit from differences in price movement.

How to Buy DigixDAO with a Broker

There are various brokers available online and offline, but choosing one that is misaligned with your investment objectives could severely impact your portfolio. When searching for the best cryptocurrency broker, there are a couple of things to consider. Factors such as security, anonymity, ease of usage, amount of coins traded on the exchange, bid-ask spread, liquidity, and escrow account are just some things. You should also pay attention to commissions, trading limits, and minimum account balances.

1. Register with the Broker

To trade DigixDAO, you need to create an account with a broker that lists DGD. There are various accounts where you can buy DigixDAO. The process of opening an account is as simple as opening an email. You are required to provide your personal details, some form of verification, and a valid email address for correspondence. Two platforms where you can buy DigixDAO are eToro and Plus500. Let us look at their account opening process below.

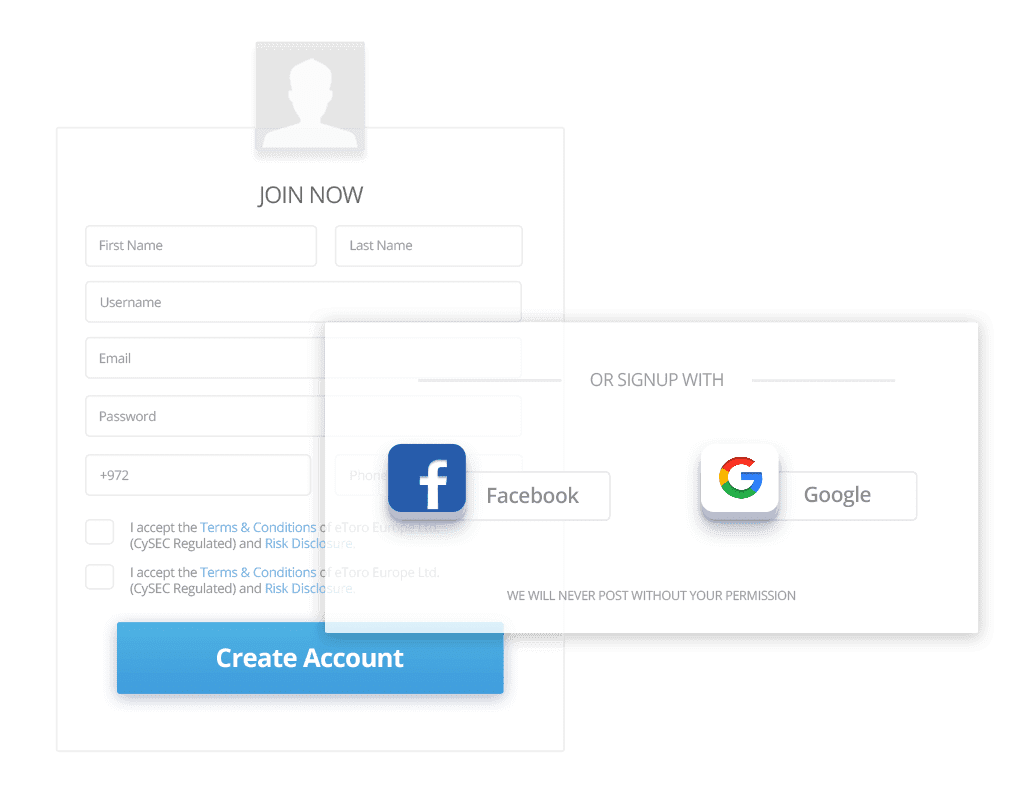

To open a brokerage account on eToro, go on to their home page, and click on the tab marked “Join Now”. An electronic form will pop up, where you enter your personal details such as name, email, password, and phone number. Once you have finished, click on “create account”. You also have the option of logging in through Facebook or Gmail.

To open a brokerage account on Plus500, go to Plus500.com, and click on the “Start Trading Now” button. A new page would pop up, requiring you to enter your email and choose a password. Once done, this would automatically log you into Plus500’s Web Trader, where you complete your account verification.

2. Verify your Identity (KYC Process)

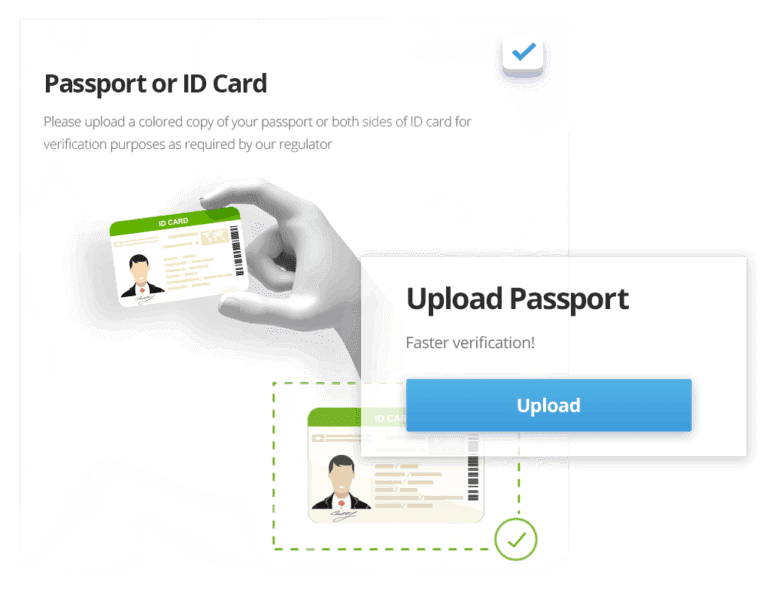

Independently from your choice of broker, you will be required to supply additional personal information and an ID to satisfy KYC (Know Your Customer) requirements before you can start trading.

To verify your account on eToro, you would be required to upload proof of identity and address. Both documents can be scanned and uploaded using the scan option on the app. For Plus 500, the process is the same, except that you have to also verify your source of funds as an extra security measure to prove you are the trading account owner.

3. Deposit Funds with your Preferred Payment Method

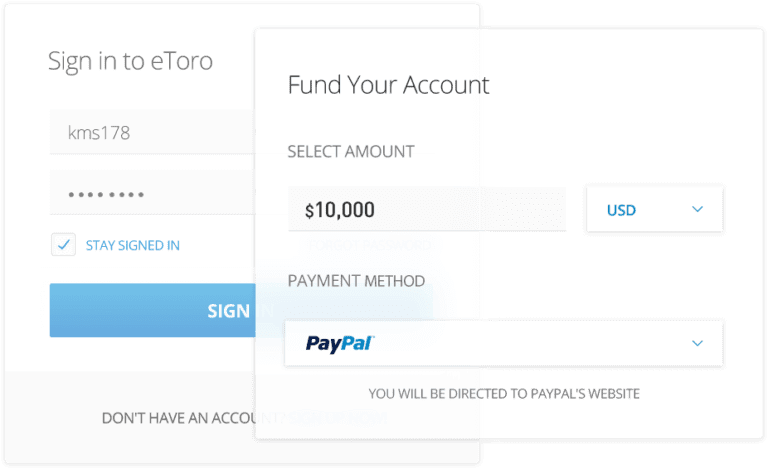

After you have opened and verified your account, you can deposit funds. This could be done in several ways. You can deposit funds through credit/debit cards, electronic wallets such as Paypal, Skrill, or Stripe, or a bank transfer to the broker’s account.

Whatever method is convenient for you and guarantees the security of your transaction is acceptable. However, it is advisable to watch out for any hidden transaction costs. You should also consider the transaction period between when you make the payment and when the amount would reflect in your account.

4. Open a Position to Long/Short DigixDAO

Depending on your fundamental or technical analysis, you can open a long or short position on DigixDAO. Opening a long position implies the trader hopes to profit from an increase in DGD’s price. In this case, we say the trader goes long. Opening a short position, or going short, means the trader hopes to profit from a decline in the coin’s price.

When in a long position, you do not use any leverage to trade because you won the coin. However, when going short, you use leverage to trade because you are borrowing the stock. As such, you need to have a margin account with a brokerage firm.

Cryptocurrencies are highly volatile, which means your gains can be wiped out in a short time. As such, risk management should be of utmost priority. Using risk management tools such as stop-loss, take-profit, or trailing stops are robust ways of protecting your portfolio.

A stop-loss order is an order used by traders to limit losses and reduce risk. The investor enters an order to exit a position if the price moves against him. By using a stop-loss order, the trader exits his position at a loss, albeit smaller than if he had held much longer, hence bringing his losses to a stop. This helps limit exposure to the market.

On the other hand, take-profit is an order that specifies the price to exit a position for a profit. Suppose the crypto coins rise to the take-profit point. In that case, the order is executed and the position is closed for a profit. An effective risk management strategy may combine take-profit (T/P) orders with stop-loss orders (S/L) when placing trades.

A trailing stop is a stop order designed to protect gains by allowing a position to remain open and continue to profit as long as the price moves in the investor’s favour. When the price moves against the position by a certain percentage, the order executes and ends the trade for a profit.

You can also go long or short through CFDs. A CFD (Contract for Difference) is a legally binding deal in which the seller or buyer agrees to pay the difference between an asset’s present and future values when the buyer decides to close the contract. If the contract’s value is higher than the starter point, the seller, or broker, pays the buyer; if the value is lower, the buyer must pay the seller out of his original position.

In this case, if you are long on DigixDAO and the price rises above your entry price, the seller pays you the difference. If the price of DigixDAO falls below your entry price, you pay the difference to the seller.

5. Close your Position

Traders close positions for two main reasons: taking profit or minimising losses. If you are long and hope to profit from an increase in the cryptocurrency price, you may be forced to close your position when the market moves against you (prices are falling). In the same vein, you may also close your position and take profits when your price target has been reached.

Furthermore, you can use T/P and S/L limits, as previously mentioned, to automate the closing of your trades. This means that even if you are away from your computer, you will be able to successfully manage your trading via hard limits.

How to Buy DigixDAO with an Exchange

Cryptocurrency exchanges allow you to access a huge range of currencies, and many of the top ones offer DigixDAO (DGD). Exchanges are best suited to those investors who want to purchase and take custody of actual DGD tokens, in the hope of long-term price appreciation.

1. Set up a DigixDAO Wallet

To buy DigixDAO (DGD), you will need to have a cryptocurrency wallet. A wallet is a device where you store your crypto coins for safekeeping. It allows you to interact with the blockchain and ensures the transfer of coins. All wallets share similar features such as a private key, public key, account balance showing funds, transaction history, and security features. The major difference lies in the means of storage which can either be hot or cold. Hot storage is when the coins are stored online, while cold storage is when the coins and keys are stored offline.

A wallet may also be hard or soft. A hardware wallet allows you to store your private keys and coins in a secure physical device. Your coins are kept offline by storing them in a physical device, which means they can’t be hacked. This makes it the most secure form of wallet, though they are expensive.

A software wallet is a piece of software that stores coins and private keys. These wallets are the most commonly used and are available in online, desktop, and mobile formats. Soft wallets utilise the cloud or an external server to store user data and information which require an internet connection to access, use, and manage them. This makes them susceptible to hacking and theft, however they are more secure than exchange wallets.

2. Choose and Join an Exchange that sells DigixDAO

There are plenty of exchanges where one can buy and trade DigixDAO. Accessibility to these exchanges depends on your location, capital requirements, payment options, security, among other factors.

For example, Coinbase is not available in some countries, while Binance has a wider outreach. Incidentally, Binance has a different platform for US citizens with limited features and options due to regulatory reasons. As such, you have to look for an exchange that suits your needs.

Some exchanges such as Binance offer tokenised coins, derivatives trading, and investment pools, while others such as Coinmama do not. Your investment objectives and environment would determine which exchange you would choose.

3. Choose Your Payment Methods to Buy DigixDAO

After choosing and registering on an exchange, the next step is making deposits to begin trading the available coins. There are a variety of payment options available to registered users on an exchange, such as credit card, bank transfer, and online payment options.

As a trader, you have to choose the process that is most convenient for you. Convenience here entails ease of payment/withdrawal, transaction costs, and the time used to settle payments. One’s location or regulatory reasons can restrict the payment process. What should be utmost in the mind of the trader is security and ease of payment.

4. Place an Order to Buy DGD

After depositing funds to your account on the exchange, you are now ready to start trading DigixDAO. You can place a buy order for the coin. Placing a buy order is generally the same in all exchanges with minute differences. To place a buy order for Binance, when you get to the home page, select the cryptocurrency of your choice, click buy, enter the amount, and select your payment option, which may be bank transfer, credit card, or P2P. After payment has been confirmed, the coin will be transferred to your wallet.

5. Safely Storing Your DigixDAO in a Wallet

As stated previously, there are various ways to store your coin in your wallet. However, the safest method is storing the coins offline in a hardware store. This cold storage method takes your coins offline, which means they can’t be hacked. Be sure to keep your hard wallet in a convenient and safe place that would be easy to remember.

However, if you are a trader, you may not need to store your coins frequently as you would need to be liquid to take advantage of price movement and market volatility. As such, you would need your coins within reach. In this case, you can leave your crypto coins in the exchange wallet to carry out your transactions because you may need them at short notice.

Should you Buy or Trade DigixDAO?

There are two ways to invest in DigixDAO. You can either buy and hold, or trade. Buying and holding is a long-term investment strategy that is anchored on fundamental analysis. The investor selects the coin to buy based on fundamental factors such as blockchain technology, liquidity, or mining with renewable energy. Those who purchase and hold ignore short-term price movement.

Traders, on the other hand, seek to profit from market volatility by using technical indicators. By using technical indicators such as RSI, MACD histograms, volume charts, or Bollinger bands, traders enter and exit positions over a shorter time frame, taking smaller, more frequent profits.

While holders are more likely to ride out short-term losses, which are deemed corrections or blips, traders attempt to profit quickly from fluctuating markets. Both types of investing strategies are facilitated through exchanges or brokers. Buying a coin through an exchange gives you ownership of the coin. However, buying through a broker does not give you ownership. Some examples of crypto brokerages include Robinhood and eToro.

What’s the Difference Between a DigixDAO Exchange and a Broker?

You can buy or trade DigixDAO through exchanges or professional brokers. An exchange is an online platform where traders meet to buy or sell cryptocurrencies. Exchanges can be likened to a marketplace where traders and speculators meet to transact. They act as intermediaries between buyers and sellers and charge commission for each transaction executed on their platform.

On the other hand, a professional broker is an individual or organisation that offers traders exposure to cryptocurrencies. He acts as a middle man between the trader and the market. Traders who buy cryptocurrencies through brokers do not own the coin but merely seek to profit from price movement. This is unlike an exchange where traders who buy the coins own the coins.

For long term holders, we recommend buying coins through exchanges as this gives you ownership of the coins and not just mere exposure. For trading, use a broker, as you don’t need to worry about storing the coins, and get much easier exposure to the underlying DGD tokens.

DigixDAO: Long Vs Short Term Investment

There are two ways to invest in DigixDAO, either long-term or short-term. A long-term investment is a strategy whereby you hold your position for several months or years. On the other hand, short-term investment is an investment strategy whereby the investors hold their position in a cryptocurrency for a short time, which could range from minutes to a year.

Long-term investors use fundamental analysis to reach investment decisions. They check a cryptocurrency’s state of network, integrity, market capitalisation, volume, and more before making an investment decision. On the other hand, short-term crypto investors use technical indicators to make trading decisions. They check price valuations, support, and resistance zones, including using technical tools such as RSI, MACD, or Fibonacci analysis.

3 Tips to Buy DigixDAO

Investing in DigixDAO is profitable only if done right. Here are 3 tips that would help you when buying DigixDAO.

1. Choose the Right Time and Do Your Own Research on DigixDAO

Timing is everything in investing or trading, especially in a volatile asset class such as cryptocurrencies. An ill-timed trade can have dire consequences for your portfolio. Choosing the best time to buy a coin depends on a combination of your investment objectives, time frame, and fundamental and technical factors. As such, the idea of the right time varies among investors and traders. However, by using technical tools and paying attention to fundamental metrics, buyers can select the most appropriate time to place their trades.

2. Comparing Costs to Buy DigixDAO

Transaction costs are an unseen expense when trading cryptocurrencies. Most traders do not pay attention to transaction costs until it has eaten deep into their portfolio. Factors that influence transaction costs include liquidity, broker or exchange commission, payment processing, and the bid-ask spread.

Transaction costs vary among brokers and exchanges. When searching for a platform to trade, it is advisable to put transaction costs into consideration. You can carry out a comparative cost analysis to ascertain which broker or exchange would be better suited for you.

3. Safety and Security when Buying DigixDAO

The safety and security of funds and coins are of utmost importance. The first rule of investing is: Never lose your capital. Losing your capital can come from a lacklustre approach to the security and safety of your wallet. This should be one of your top priorities when searching for a broker or exchange to buy coins. It is advisable to use platforms that offer different layers of security and guarantee anonymity.

What is the Best Payment Method for Buying DigixDAO

- Buy DigixDAO with Cash - Only advisable when you know the seller or if you have a crypto ATM available

- Buy DigixDAO with Credit Card - This is one of the most frequent payment methods

- Buy DigixDAO with Bank Transfer - This payment is straightforward and accepted by most platforms

- Buy DGD with Bitcoin - Buying DigixDAO with Bitcoin can be convenient, especially to preserve our privacy in an exchange with another trader

- Buy DigixDAO with PayPal - PayPal is a safe payment method that also offers protection against scammers

Other Ways to Buy DigixDAO

Apart from buying directly from exchanges and brokers, there are alternative ways of acquiring coins. You can decide to mine for the cryptocurrencies. This entails setting up mining rigs and solving complex mathematical equations which reward you coins when they are solved. You can also choose to stake or pool your investments.

Some exchanges such as Binance offer this option to traders who do not want to trade in the marketplace. Here, the investor lends his coins on the exchange for a particular period and accrues interest payments. This is a low-risk strategy and acts as a hedge against volatility.

You can also buy coins through a peer-to-peer (P2P) network. P2P is a feature that allows sellers and buyers to transact without fear of losing capital to commission or exchange fees. The exchange acts as an intermediary, bringing both buyers and sellers together. A buyer transfers the specified amount to the seller, who releases the coins to an escrow account managed by the exchange. After payment has been verified, the exchange releases the coins to the buyer’s account.

DigixDAO is a token that could revolutionise how we trade commodities such as gold. By offering gold-backed digital tokens, crypto traders may have an alternative source of stability, an important and yet missing part of the ever-growing crypto space.

Frequently Asked Questions

-

DigixDAO is listed on several exchanges, including Binance and Huobi.

-

DigixDAO can be stored in any ERC20-compatible wallet.

-

As of the time of this writing, DigixDAO had a market cap of $925.4M.

-

With a total supply of 2 million tokens, scarcity is a major value for this token. With other cryptocurrencies, this meant that prices trended higher as the supply became more limited over time.

-

It depends on your goals as an investor. If you want short-term, quick profits, you should consider trading; the investor with a lower time preference should consider investing for the long run.

Alternative Cryptocurrencies